AIA new portal wins in the Asian Experience Awards by Asian Business Review for seamless claims process

AIA’s latest digital innovation raised the standards on claims experience, providing greater peace of mind with financial assurance so that customers can focus on recovery.

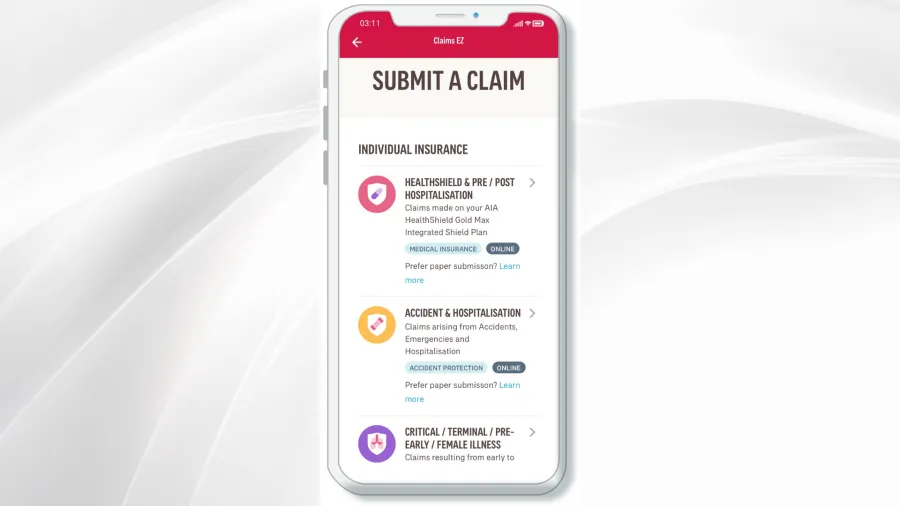

AIA transformed the claims process with its Claims EZ portal, delivering a seamless, end-to-end online experience for its customers with claims paid within one to four business days from submission as compared to the industry average of two weeks minimum. This innovation also resulted in 20% improvement in claims satisfaction within a year.

Claims EZ was developed in partnership with AiDA Technologies to create a simple and fast claims experience for customers and streamline operational efficiencies.

According to AIA, a 2020 study found that approximately 6 in 10 consumers wanted a faster claims process for payment. With added financial anxiety stemming from the pandemic, insurers needed to step up efforts to reassure customers of their ability to process and pay out claims quickly.

The portal allows for digital submissions authenticated using AIA 2FA or Singpass Mobile. It also features auto-extraction of invoice information using AiDA’s proprietary SMART-OCR (Intelligent Information Extraction) Engine and auto-registration of cases.

For straightforward claims, immediate claims decisions are made through auto-adjudication using Artificial Intelligence and supervised Machine Learning, whilst outlier identification is accomplished using advanced unsupervised machine learning. This allows claim assessors to focus on examining more complex claims, reducing the turnaround time for customers.

Pre-authorisation requests are also automatically assessed via Claims EZ with over 80% of such requests approved within one day and before any treatment costs are incurred. Pre-authorisation is a service that facilitates AIA HealthShield customers to get their medical bills pre-approved before admission or surgery at private specialist clinics or private hospitals. This allows customers to focus on recovery knowing that the bill is fully claimable and treatments are in line with medical best practices.

Simplifying and expediting the claims experience from submission to payment is a critical service proposition that significantly impacts customer satisfaction.

As AIA continues to feed the Claims EZ AI engine with more data, the system will eventually be able to identify anomalies more accurately in claims patterns, detect fraudulent and high-risk cases, and flag such cases to claim assessors for further investigation.

In the long run, AIA said that this supports proactive claims management, allowing the company to moderate the rate of health insurance premium increases while maintaining a healthy claims reserve pool, enabling consumers to enjoy continued access to quality and affordable health insurance.

For this innovation, the AIA’s Claim EZ portal was recognised with the “Singapore Digital Experience of the Year - Financial Services” award in the recently concluded Asian Experience Awards by Asian Business Review.

The awards programme recognise the ingenious initiatives of creative companies delivering meaningful brand experiences to their stakeholders in all industries in Asia.

Advertise

Advertise