Western Digital snags AI award for manufacturing in Malaysia Technology Excellence Awards

It won for its real-time test equipment that comes with predictive maintenance.

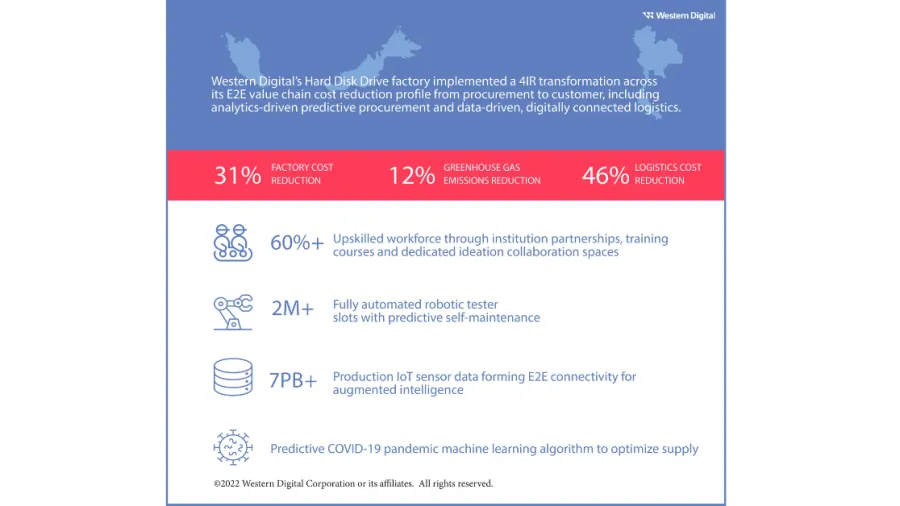

The Western Digital team was faced with a number of problems that led to the development of the solution that won the award. Western Digital’s test process is highly digitized. However, with have over 2 million test slots to manage, even a small percentage of downtime can mean more than 12,000 tester slot issues reported per day for repair.

Western Digital is committed to continuing its growth in the industry. To address these problems, the company developed a solution that enables real-time test equipment performance monitoring and optimisation with predictive maintenance.

The solution features machine learning-based automated suggestive maintenance repair actions and adaptive self-healing or repair capabilities which improved tester slot repair efficiency and root cause identification.

On top of that, it also enables real-time monitoring of test equipment performance, such as Dashboard, KPI (Key Performance Indicator), and OEE (Overall Equipment Efficiency), with automated condition-based predictive maintenance alert. This includes remote monitoring and remedy capability which supported employees who were working from home during the COVID-19 pandemic whilst keeping the factory operational.

For this project, the company was given the AI – Manufacturing award in the recently concluded Malaysia Technology Excellence Awards hosted by Singapore Business Review.

The annual awards programme recognises exceptional companies who are riding the disruption wave and leading the technological revolution and digital journeys of their respective industries to boost Malaysia’s fast-growing economy.

In granting the award, the judging panel considered key achievements attained by the company. First is that it observed test slot OEE improvement from 84% to 90%, which resulted in an 8% reduction in CAPEX spending.

It also experienced a 15% reduction in test slot shutdown, as well as a 20% improvement in repair and debug troubleshooting accuracy.

According to the company, certain technologies and enablers helped in the making of the project. It has a web-based application development platform with cloud data storage and computing, add to that is its machine learning to automate suggestive maintenance and self-healing tester slot repairs.

This is complemented by the big data platform for large data and machine learning computation and development, the Edge architecture for real-time monitoring, machine learning scoring and disposition, and its Agile scrum-based development team.

The company also said that it has 3-layer stacks with different data breath, depth and latency for greater scalability and higher availability to support various projects and use cases.

First is the Shop Floor Layer which has factory automation, IIoT sensors, and streaming data applications. The second is the Edge Layer which has fast and low latency data, enabling fast scaling for AI applications with CI/CD (Continuous Integration / Continuous Deployment) features. Third is the Cloud Layer which has a big data platform of about ~10PB, which can manage wider or end-to-end data and longer retention.

Advertise

Advertise