Fintech startup streamlines SME credit assessment for banks through AI

With InRiskable, banks can assess SMEs’ credit risks with 80% less time and 97% accuracy.

One of the great challenges for banks these days is the accurate assessment of credit risks associated with small and medium-sized enterprises (SMEs). It is in this time of continuing financial expansion and growing complexity that Hong Kong-based startup inRiskable enters the scene with its AI-powered solutions.

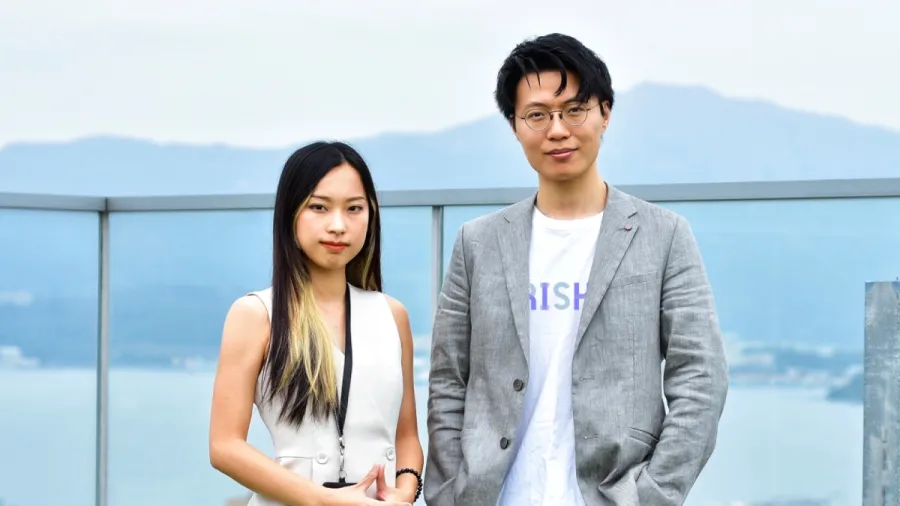

Deriving its name from a mix of the words “invisible” and “risk,” the firm co-founded by Megan Chau in 2022 helps financial institutions “discover the invisible risks [of SMEs] out there on the internet.”

“Banks always deal with a lot of SMEs. For example, 10,000 [SMEs]: ‘How can I manage 10,000 SMEs at the same time?’” Chau told Asian Business Review. “What we’re doing is we use AI to help them to automatically filter out the high risk level and the low risk level so that the analysts can minimise the time to do it.”

By utilising AI, the risk intelligence platform is able to minimise the amount of time and effort to exercise due diligence for SMEs. “In our experience, about 80% of the time can be reduced and our accuracy is 97%,” she said.

No wonder, the demand for such agile and reliable banking services has hit at an all-time high. Whilst the financial landscape is rapidly evolving, traditional methods of credit risk evaluation no longer suffice.

The challenge

For financial institutions, fulfilling its responsibility and task to know their customers thoroughly and ensure security has become a tall order.

Almost every time a bank makes an assessment, it is faced with the lack of data and reliable sources when it comes to business information. For SMEs, in particular, shared information is usually limited to financial reports and oftentimes this is not enough to fully evaluate the company’s credit risks.

“The way they’re doing it is mainly based on the financial report [of] the SME profile [of their] financial data. For example, if they want to open a bank account or if they try to request for financial service from the bank, they use the financial report to do so. But financial reports are not really often reliable or cannot reflect your credit risks in a timely manner,” Chau explained.

“Actually, they try to Google it or they try to do it in Baidu or whatever such channel they can find. But it’s not very structured, it’s not standardised and it takes a lot [of time] and a lot of effort to do so. But it’s still not reliable,” she added.

InRiskable provides the platform that bridges this information gap between SMEs and financial institutions through more efficient and accurate ways of gathering data, Chau asserted.

“We do it in a SaaS way and we’re helping financial institutions to evaluate SMEs credit risk,” she said, noting that their AI-powered solution is tailored to illuminate the obscured risks that SMEs carry - risks that often go unnoticed until they manifest into larger financial calamities.

Besides the lack of data, banks also contend with the lack of available platforms that can provide them the information they need. “We can’t see many platforms providing this kind of data because Moody’s or Bloomberg, they all do it for larger [corporations],” Chau pointed out.

Filling this gap, Chau said that, “we want to be the next Moody’s for SME credit assessment, because SMEs want financial service from [banks] and [banks] want to know more about SMEs so that they can both do business safely. So when they think about SME credit risk, they will think about InRiskable.”

Identifying invisible risks

There is not a lot of data out there about SMEs, said Chau: “for example, if they have some litigation court cases, or if they have some negative news outside.

By utilising AI, InRiskable’s risk intelligence platform is able to minimise the amount of time and effort to exercise due diligence for SMEs, she said.

InRiskable acts as the right hand for banks in need of credit risk assessment support. “If I’m a bank [and] I need to do business with this SME because they [want to] apply for [a] loan from our bank, I [will] do the approval for them,” Chau said.

The platform identifies and examines 23 risk categories to determine credit scores for SMEs. Those that fail the risk evaluation will be flagged with the supporting information and will be classified as “high risk.”

“We do it in a way that is very similar to ChatGPT right now, because ChatGPT is gathering all the information online in a big data link. We extract the data that is free and everything behind the paywall we will not take unless the customer has paid for the license,” she said.

“For example, if they want Bloomberg data, then they have to pay for the Bloomberg data to connect it to our app platform. [But] we [also] have a lot of new sources [which] is around 800 right now,” she added.

InRiskable’s platform also offers two different services for enterprises. One works specifically for identifying and preventing fraud and the other focuses on AML screening.

These two services can be availed separately. The AML screening is an automated programme that doesn’t use AI and can be subscribed for monthly updates, depending on the preference of the client.

“We do it in a subscription way with some limited quarters and separated by different tiering. If you do more search, then your tier [will be] more expensive,” said Chau.

Expansion strategies

This year, Chau said that they are looking to start raising a seed round in the third of last quarter.

“We will enter the pre-seed accelerator in Singapore in March 2024. We are also a member of the Science Park Incubation in Hong Kong.

When asked where the future funding will be used, Chau said that mainly it is for the expansion of the team. “We believe that there are a lot of opportunities [in] dealing with [SMEs] in Southeast Asia and we want to expand our business to Singapore, Malaysia, and [the rest of the] Southeast Asian market,” she said.

At present, the plan is to leverage InRiskable resources to build a SaaS model. Initially, it was developed for corporate use, but eventually Chau wants to enable more people to use it.

“It [would] be amazing if everyone [can use it], if they need to search for the news about the company they’re working with, they can just go onto the portal and do the search. And with that funding, it will allow us to do a SaaS model to allow more people to use it,” she said.

Advertise

Advertise