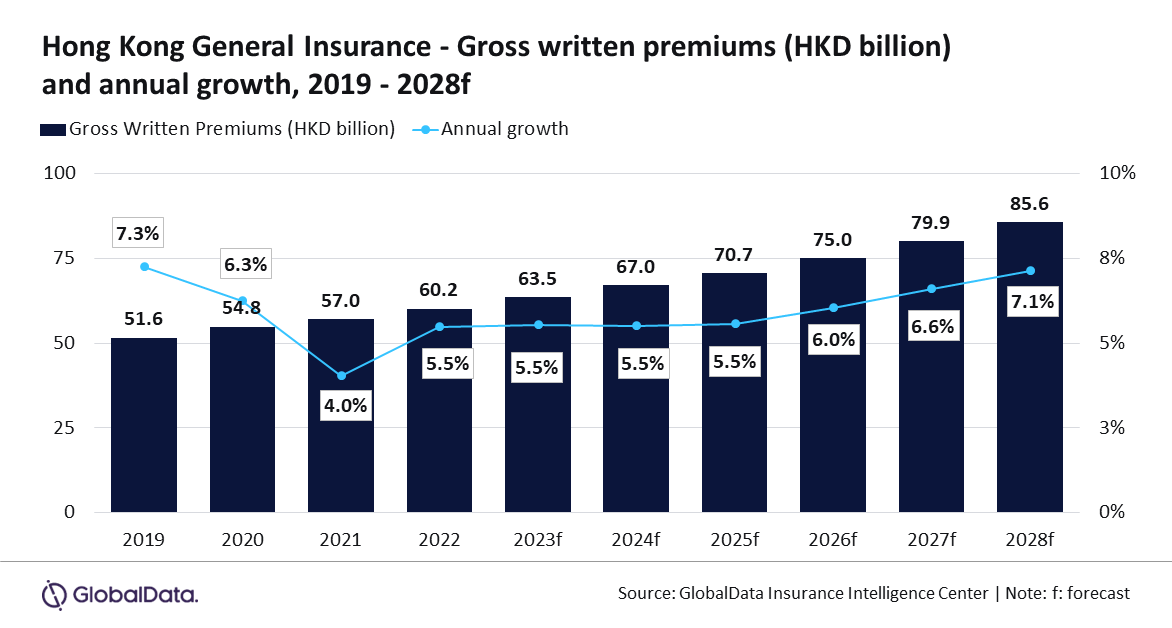

Hong Kong general insurance GWP to reach $10.9b by 2028

Rising consumer prices can affect the industry’s profitability in the short-term.

The Hong Kong general insurance industry will experience significant growth, with a compound annual growth rate (CAGR) of 6.3% from $8.6b in 2024 to $10.9b in 2028, in terms of gross written premiums (GWP).

GlobalData projected that the growth trajectory is supported by key insurance lines such as personal accident and health (PA&H), liability, and property, which collectively contributed 75% of the general insurance GWP in 2023.

“Hong Kong general insurance industry witnessed a consistent growth of 5.5% in 2022 and 2023. The growth was supported by a recovery in the demand for health and travel insurance policies from mainland Chinese customers, mandatory insurance classes, and rising medical inflation that resulted in an increase in the premiums for health insurance policies. The trend is expected to continue in 2024 and 2025,” GlobalData’s Anurag Baliarsingh, Insurance Analyst, said in a media release.

PA&H insurance, the leading line of business, held a 31.4% share of the general insurance GWP in 2023. It is anticipated to grow by 7.2% in 2024, driven by increased health awareness, recovery in demand from mainland Chinese customers post the easing of travel restrictions, and rising medical inflation.

“Chinese customers are mostly attracted by the superior care, high-quality medical facilities, and shorter waiting times offered in Hong Kong. The health insurance policies offered in Hong Kong include options for additional coverage for family members, higher coverage for specific types of illness, and severity-based protection that are not available in the policies offered in Mainland China,” added Baliarsingh.

ALSO READ: Hong Kong’s women in insurance rising in a male-dominated business sector

Liability insurance, comprising a 24.1% share of the general insurance GWP in 2023, is the second-largest line.

Hong Kong ranks as the fourth-largest liability insurance market in the APAC region, primarily due to mandatory classes of insurance such as employees’ compensation (EC) insurance. Government-mandated compensation levels for specific diseases are expected to boost premium prices and support a CAGR of 6.1% during 2024-28.

Property insurance, with a 20.0% share of the general insurance GWP in 2023, is the third largest line.

It grew by 5.7% in 2023, driven by mandatory third-party property risk insurance and investments in large-scale infrastructure projects. Property insurance is forecasted to grow at a CAGR of 6.7% during 2024-28.

Financial Lines, Motor, and Marine, Aviation, and Transit (MAT) insurance collectively contributed 24.5% to the general insurance GWP in 2023.

“The growth in Hong Kong’s general insurance industry over the next five years is expected to be driven by economic recovery, an increase in inbound tourism, and rising health awareness. However, highly volatile market conditions due to rising inflation levels can impact the profitability of general insurers in the short-term.” concluded Baliarsingh.

Advertise

Advertise