Australia, NZ retail banks face tougher headwinds

Both loans and deposits will see increased competition.

Small-scale retail banks in Australia and New Zealand are seen to find it more challenging to navigate cyclical and structural headwinds, warned Fitch Ratings.

“We expect increased competition for both loans and deposits, the weakening of customer loyalty amid a commoditization of products, and the digitisation of service offerings and related investment requirements to challenge the competitive position of some smaller or regional banks and non-bank deposit takers (NBDTs) in the two markets,” Fitch Ratings said.

“In addition to slower growth in deposits and loans relative to the system, an erosion of their competitive position could lead to net interest margin attrition amid increased price competition, or prolonged deterioration in the loan/customer deposit ratio,” it added.

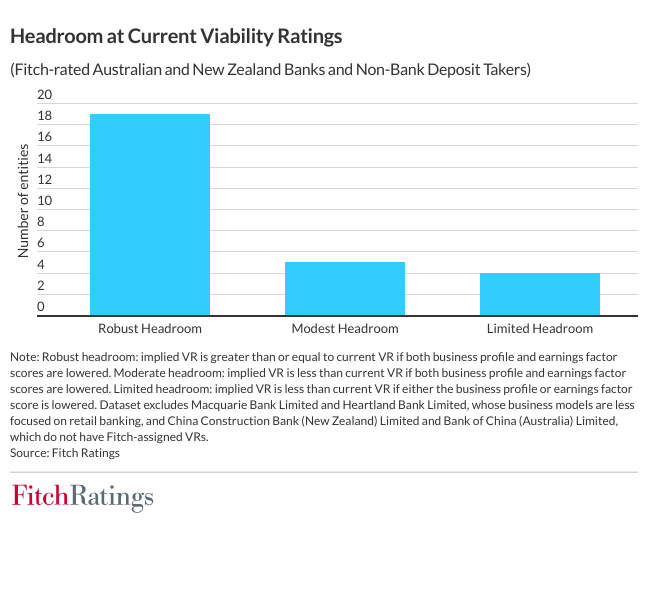

Fitch Ratings uses seven key drivers, including earnings, profitability, and business profile, to determine a bank’s standalone Viability Rating (VR).

Despite the tough environment, most institutions’ VRs are expected to remain consistent with their current levels, supported by their long trading histories, stable business models, and conservative underwriting practices. However, a few banks have limited VR headroom.

The challenging environment might prompt smaller banks and NBDTs to consider consolidating or taking on riskier exposures, potentially leading to higher losses, earnings volatility, and pressure on capitalisation. Such actions could trigger downward revisions in their risk profile and asset quality scores.

Advertise

Advertise